Tired of saying "I’ll remember it later"? This app finally freed my time

We’ve all been there—juggling errands, bills, and plans, only to realize we forgot something important… again. That constant mental load isn’t just frustrating; it steals hours from your week. I remember standing in the grocery store, staring blankly at my list, trying to recall whether I’d already bought laundry detergent. Or worse—getting that sinking feeling when I opened my bank statement and saw an unexpected charge I’d completely forgotten about. That nagging voice in my head—"I’ll remember it later"—had become a broken promise. But what if a simple tool could quiet the chaos and give you back time for what truly matters? I felt the same—until I started using spending reminder apps not for budgeting, but for *time recovery*. Here’s how they quietly transformed my days.

The Hidden Time Drain: When "I’ll Remember" Costs You Hours

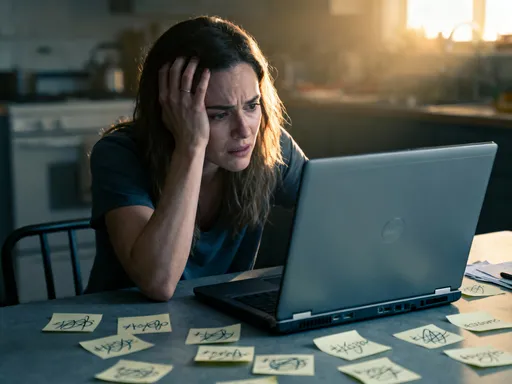

Let’s talk about something we rarely measure—mental clutter. It’s not just physical mess that slows us down; it’s the invisible weight of remembering. Think about how many times a day you pause to ask yourself: Did I pay that bill? Did I cancel that subscription? Is there enough in the account for this purchase? These aren’t just small questions—they add up to real, lost time. Studies show the average person spends nearly 15 minutes a day retracing forgotten tasks or decisions. That’s over an hour and a half every week. For someone like you, juggling family, work, and personal needs, that’s precious time you can’t get back.

And it’s not just about time—it’s about energy. Every time you have to stop and think, "Wait, did I…?" you break your focus. That mental interruption makes it harder to concentrate on what you’re doing, whether it’s helping your child with homework or finishing a work project. I used to carry a notebook everywhere, jotting down reminders: "Call dentist," "Renew car insurance," "Check electricity bill." But even then, I’d lose the notebook, forget to check it, or misplace it in the chaos of the day. The truth is, our brains aren’t designed to be storage units. They’re meant for thinking, feeling, creating—not for holding onto due dates and passwords.

The "I’ll remember it later" mindset is a trap. It feels harmless in the moment, but over time, it creates a background hum of stress. You’re never fully present because part of your mind is always scanning the past, trying to catch what you might have missed. And when you do forget—like that $12.99 monthly subscription that kept renewing—you don’t just lose money. You lose trust in yourself. You start to feel like you’re always one step behind. But here’s the good news: you don’t have to live this way. There’s a smarter, kinder way to manage the small things—so you can focus on the big ones.

Beyond Budgeting: How Spending Reminders Become Time Saviors

When most people hear "spending reminder app," they think about budgeting. They imagine spreadsheets, categories, and guilt over coffee runs. But that’s not how I use these tools—and it’s not how they’re most powerful. For me, spending reminders aren’t about restriction. They’re about *freedom*. They’re like having a quiet assistant who whispers, "Hey, that bill is due in two days," or "You haven’t checked your grocery spending this week." And the best part? They don’t just save money—they save time.

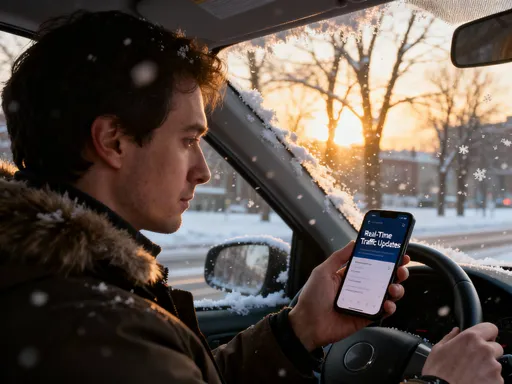

Think about it: how much time do you spend logging into bank accounts, checking statements, or scrolling through receipts? With automated reminders, you don’t need to. The app does it for you. You set it once, and it works in the background. No more frantic searches for payment portals or last-minute panic when a due date slips through. These alerts reduce what psychologists call "decision fatigue"—that mental exhaustion that comes from making too many small choices. When your phone gently reminds you that your internet bill is due, you don’t have to remember it. You just act. Simple. Clean. Done.

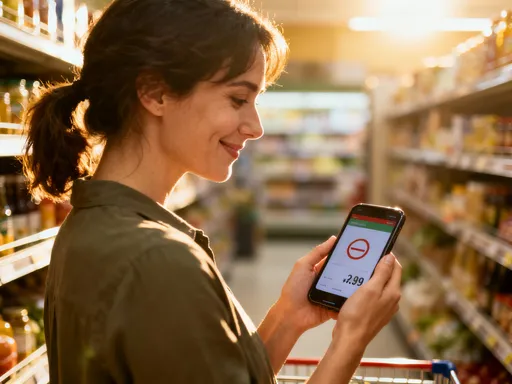

And it’s not just about bills. Many apps now offer "purchase pause" reminders—alerts that pop up if you’re about to make an impulse buy. Instead of asking, "Can I afford this?" they help you ask, "Do I really want this?" That split-second pause can save not just money, but the time you’d spend regretting the purchase later. Or returning it. Or just feeling guilty about it. These tools don’t control you—they support you. They handle the routine tracking so your mind can stay clear, focused, and at peace.

The Morning That Changed Everything: A Real-Life Turning Point

I’ll never forget that Tuesday morning. My daughter was looking for her school project supplies, my son was asking for lunch money, and I was trying to figure out why my bank account was $30 lower than I expected. I finally traced it to a forgotten subscription—some app I’d downloaded months ago and never used. I felt overwhelmed, frustrated, and frankly, a little ashamed. How could I manage a household if I couldn’t even track a $5 charge?

That afternoon, I sat down and downloaded a simple spending reminder app. I didn’t go all in—just one small change. I set up a weekly grocery budget reminder. Every Sunday, it would send me a notification: "Your grocery budget is $120 this week. You’ve spent $87 so far." That’s it. No charts. No categories. Just a gentle nudge.

But something amazing happened. That first week, I actually *stayed* within budget. More importantly, I spent less time thinking about it. I wasn’t constantly calculating in my head or second-guessing every item. I trusted the reminder. And because I wasn’t mentally drained by grocery decisions, I had more energy for other things—like helping my daughter with her science fair project without rushing or snapping. That small win gave me confidence. If this tiny tool could make grocery shopping easier, what else could it do?

I started adding more reminders: one for my water bill, another for my car insurance renewal, and even a "cooling-off" alert for purchases over $50. Within a month, my mornings changed. No more frantic bill checks. No more "Did I pay that?" anxiety. Just calm, clarity, and time. Real time. Time to sip my coffee. Time to read the news. Time to just *breathe*.

How It Actually Works: Setting Up for Time, Not Just Money

You might be thinking, "This sounds great, but isn’t it complicated?" I thought the same. I’m not a tech expert. I don’t have hours to set up systems. But here’s the truth: setting up spending reminders for time savings is surprisingly simple. You don’t need to become a financial wizard. You just need to focus on the right features.

Start with bill reminders. Most apps let you link your accounts or manually enter your bills. Set them to notify you 3–5 days before a due date. That way, you’re not scrambling at the last minute. I like to set mine for Thursday so I can handle everything over the weekend, when I’m not rushed. Next, turn on subscription tracking. The app will scan your transactions and flag recurring charges. You’ll be amazed at how many you’ve forgotten. I found three I didn’t even remember signing up for—one was a meditation app I’d tried for two days and never used again!

Then, use the "purchase reflection" feature. This isn’t about stopping you from buying things you love. It’s about giving you a pause. For example, I set mine to trigger for any purchase over $30. A message pops up: "You’re about to spend $45 on home decor. Is this part of your plan?" It’s not judgmental. It’s just a moment to check in with yourself. And honestly? I’ve skipped at least five impulse buys since I started using it. Not because I couldn’t afford them, but because I realized I didn’t really want them.

Finally, customize your notifications. You don’t want to be bombarded. I’ve turned off alerts during family time and late at night. I get one daily summary in the morning with anything urgent. That way, I stay informed without feeling interrupted. It’s not about being perfect. It’s about creating a system that works for *your* life.

Regaining Focus: Less Mental Load, More Real Living

Here’s what no one tells you about time-saving tools: the biggest benefit isn’t the time you get back. It’s the *quality* of your attention. When you’re not constantly worried about forgotten tasks, your mind feels lighter. You can actually focus on the people and things you love. I noticed it first at dinner. Instead of mentally reviewing my to-do list, I was really listening to my kids. I heard the little things—their jokes, their worries, their dreams. That presence made our conversations deeper, warmer, more connected.

And it spilled over into other areas. At work, I found I could concentrate better. I wasn’t distracted by "Did I pay that invoice?" thoughts. I finished projects faster and with less stress. Even my hobbies improved. I started painting again—something I’d given up years ago because I felt too busy. But now, with fewer mental distractions, I had the mental space to create. It wasn’t just about doing more. It was about *feeling* more—more peace, more joy, more confidence in my ability to manage life.

That’s the real gift of these tools: they don’t just organize your finances. They organize your mind. And when your mind is clear, everything else gets easier. You sleep better. You react more calmly to surprises. You feel more in control, not because you’re doing more, but because you’re thinking less about the small stuff. You start to believe in your own competence again. And that belief? It changes everything.

Beyond the Individual: Calmer Homes, Smarter Habits for Everyone

Here’s something I didn’t expect: when I started using spending reminders, the whole household changed. My husband noticed I was less stressed. My kids said dinner felt calmer. And slowly, we started sharing the system. We added a shared grocery list in the app. Now, if one of us buys milk, it’s marked off for everyone. No more "Did you pick up bread?" texts at 8 p.m. We even set up a joint alert for our vacation fund—"You’ve saved $1,200 toward the beach trip!" It’s become a little celebration every time it pops up.

And the best part? Fewer arguments. So many family tensions come from forgotten tasks or surprise expenses. "I thought you were paying the internet bill." "You didn’t tell me we were on a budget!" Those little misunderstandings fade when everyone is on the same page. The app doesn’t replace communication—it makes it easier. We talk more because we’re not stressed. We plan together because we can see our progress. It’s turned a financial tool into a relationship tool.

Even our kids are learning from it. My daughter started using a simplified version for her allowance. She sets reminders for saving toward a new book or toy. It’s teaching her responsibility—not through lectures, but through real experience. She feels proud when she reaches her goal. And that pride? That’s the foundation of confidence.

The Ripple Effect: From Minutes Saved to a More Intentional Life

When I look back, I realize that those small, saved minutes added up to something much bigger. I didn’t just get time back—I got my life back. The time I used to spend worrying, I now spend creating. The energy I used to waste on mental clutter, I now pour into my passions. I’ve started a small garden. I’m taking an online course in photography. I even have time to call my mom just to chat.

And here’s what I’ve learned: technology doesn’t have to be a distraction. It can be a partner in living well. A spending reminder app isn’t just a gadget. It’s a quiet ally in your daily life—a tool that says, "You don’t have to carry everything. Let me help." It’s not about perfection. It’s about peace. It’s not about control. It’s about care—for your time, your mind, your family, and yourself.

If you’re tired of saying "I’ll remember it later," maybe it’s time to let technology remember for you. Not to replace your judgment, but to support it. Not to complicate your life, but to simplify it. Because you deserve to live with more ease, more clarity, and more joy. And sometimes, the smallest tools make the biggest difference. Try it. Set one reminder. See how it feels. You might just find, like I did, that a little tech can give you back the most precious thing of all—time to live.